Watching the cannabis industry in recent years brings to light a familiar pattern seen in many emerging markets: companies merging and consolidating into larger entities. This movement towards bigger players acquiring smaller operations and combining resources seems inevitable as the market matures, but for small growers, it raises questions that are not yet fully answered. What does this merging mean for the landscape they occupy? How does the widening gap between giants and independents shape the future of cultivation on the ground?

The current momentum behind consolidation

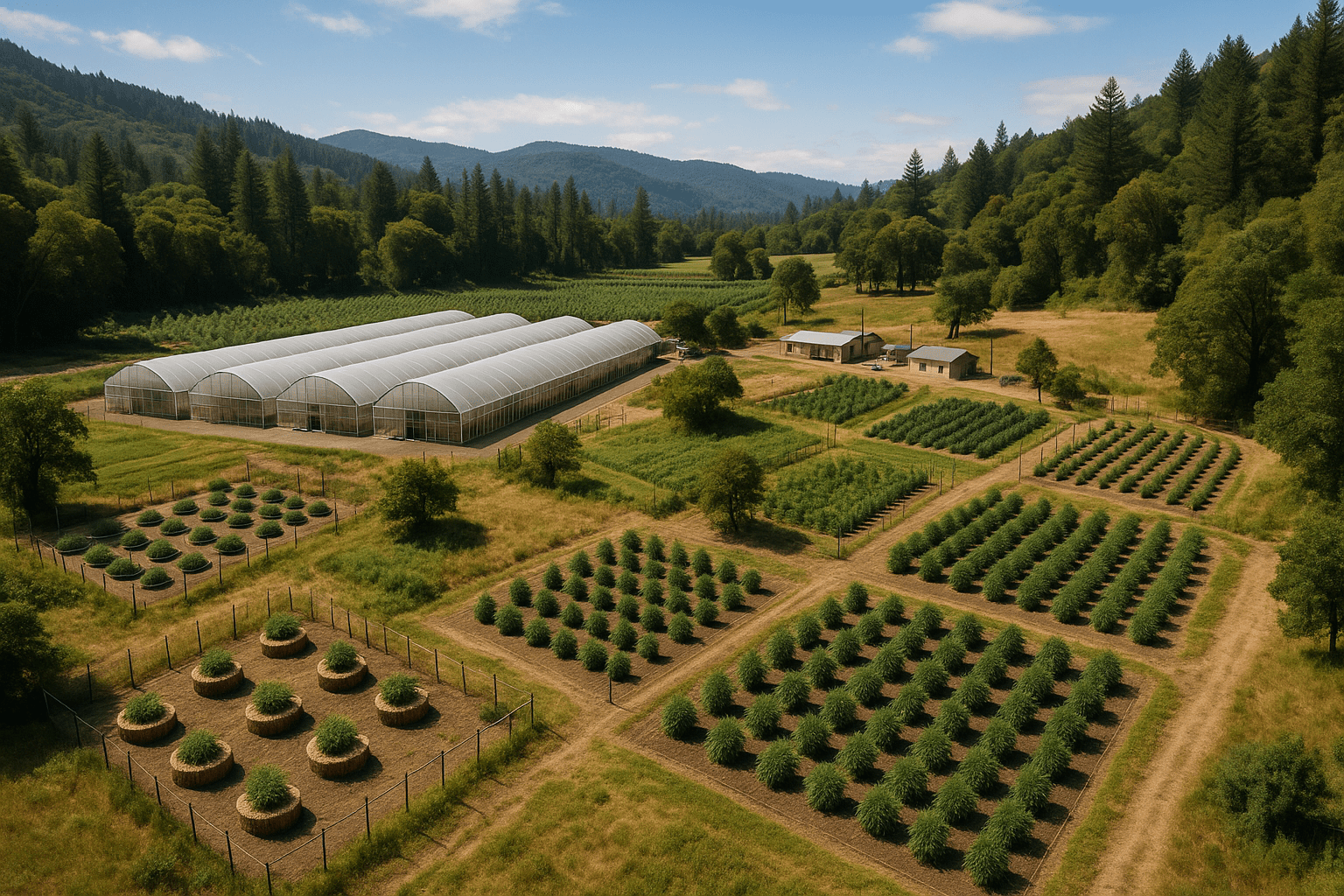

Looking at the trends, consolidation in cannabis is driven by economic pressures and regulatory hurdles that favor size and scale. Larger companies can spread compliance costs, navigate complex licensing frameworks more easily, and attract investment by presenting a lower risk profile. In contrast, small growers often operate on thinner margins and face more hurdles in scaling, which can make them targets for acquisition or push them out if they cannot compete.

Across states and countries where cannabis is legal, purchases and mergers marked by public announcements capture most attention, but beneath the surface, a constant flow of smaller deals reshape local markets. This pattern mirrors what happened in the early days of the alcohol industry or even tech sectors, where early fragmentation gave way to fewer, more powerful players who could build extensive distribution and branding.

For the cannabis sector, those big players often seek to gain access to unique genetics, growing expertise, or loyal customer bases tied to regional cultivators. There’s a clear incentive to consolidate to build vertically integrated companies that control everything from seed to sale. Growing evidence shows such integration boosts operational efficiency, but it also affects diversity in the marketplace.

The challenges small growers navigate amid these shifts

Small growers increasingly find themselves balancing between staying independent and surviving financial or regulatory headwinds. The rising cost of compliance, including testing, labeling, and security, exerts significant pressure. Small operators who once thrived in informal or less regulated segments face the task of upgrading operations to meet rigorous standards alongside larger competitors.

Moreover, distribution pathways increasingly favor well-capitalized companies with established relationships in retail and wholesale arenas. Many small growers lack the infrastructure or resources to reach broader markets efficiently, which can trap them in local loops, limiting growth. Without broader scale or partnerships, volatility in prices and demand can threaten their sustainability.

On the flip side, some small cultivators find niches by focusing on craft quality, local identity, or specialized genetics that larger firms overlook. This artisan approach can create loyal customer segments that value uniqueness and authenticity. Still, even such differentiation has limits when price competition intensifies or when branding budgets dwarf the means of smaller operations.

Patterns that foreshadow possible futures

In scrutinizing historic parallels, the alcohol industry provides an observation point. Small breweries were swallowing or sidelined during periods when consolidation reigned, yet craft beer made a comeback by emphasizing grassroots connection and quality. Cannabis may track some of these dynamics but with added complexity from shifting legal frameworks and social equity conversations.

The ongoing consolidation also raises concerns about genetic diversity and innovation. When a handful of large companies dominate breeding and seed supply, the risk emerges that unique strains cultivated by smaller growers could fade or become proprietary. This has implications not just for growers but for consumers who seek variety beyond what mass production offers.

Regulatory changes add another variable. In some markets, laws are evolving to protect or promote small and craft growers through licensing priorities or caps on ownership, aiming to preserve sector diversity. These interventions could slow consolidation or create more hybrid ecosystems where giants and locals coexist with clearer roles.

What small growers are learning from observation and adaptation

Those watching closely note that small growers who adapt to new realities often do so by forming cooperatives, leveraging direct sales models, or aligning with complementary businesses like dispensaries focused on local products. This community-minded approach counters some of the scale-related disadvantages by building local market loyalty and pooling resources.

Technological adoption also plays a role. Efficient cultivation technology that improves yields and consistency can help smaller operations maintain competitiveness even without the capital depth of large firms. However, access to such tools depends on their affordability and the grower’s willingness to experiment or invest.

Ultimately, small growers seem to be navigating a landscape where adaptability, focus on unique offerings, and strategic partnerships offer some pathways to sustainability. The market’s evolution is uneven and locally nuanced, so sweeping generalizations fail to capture the lived reality of many cultivators.

Watching consolidation patterns offers valuable insight but does not present a straightforward story of disappearance of small growers. Instead, it reveals a shifting terrain marked by tension between scale and authenticity, corporate interests and local roots, standardization and diversity. In that tension, many growers find motivation and space to innovate their craft and community engagement.

The cannabis industry will surely continue to evolve, shaped by economic, legal, and cultural forces. Those who observe with care and respond with grounded strategies stand a chance to sustain their place in a marketplace that balances consolidation with pockets of resilience.

For anyone interested in cannabis cultivation or industry trajectories, appreciating the nuances behind consolidation reveals not only risks but also the potential for new forms of growth grounded in lived experience and local knowledge. The stories behind the headline deals are quieter but no less significant.

To follow the complex developments in cannabis market structures, it helps to watch various reliable sources tracking licensing, mergers, and regulations. Sites like the Leafly industry news provide ongoing reports tailored to the cannabis sector. For regulation-specific details, the National Association of Boards of Pharmacy shares important updates on compliance standards across states. From an investment and corporate perspective, New Cannabis Ventures offers summarized market insight and deal coverage.

These sources help contextualize the observable trends beyond headlines and connect patterns to what growers experience and the options they have in a transforming industry.

Sources and Helpful Links

- Leafly industry news, a resource for ongoing cannabis business and market developments

- National Association of Boards of Pharmacy, detailing regulatory standards and updates relevant to cannabis products

- New Cannabis Ventures, a platform summarizing cannabis mergers, acquisitions, and market trends